Differentiation in an Undifferentiated Market

Merchants realize that having a loyalty program is a standard requirement and not an added feature in consumer eyes, but the structure of their loyalty offerings can differ between verticals and between merchants operating in the same vertical. In the fuel sector specifically, it can be difficult to create a distinct image as consumers typically view the purchase of fuel as a necessity, and will purchase based on price before they purchase based on brand. As fuel brands vie for consumer loyalty in a market selling a largely undifferentiated product, brands look to their loyalty programs to distinguish themselves from competition.

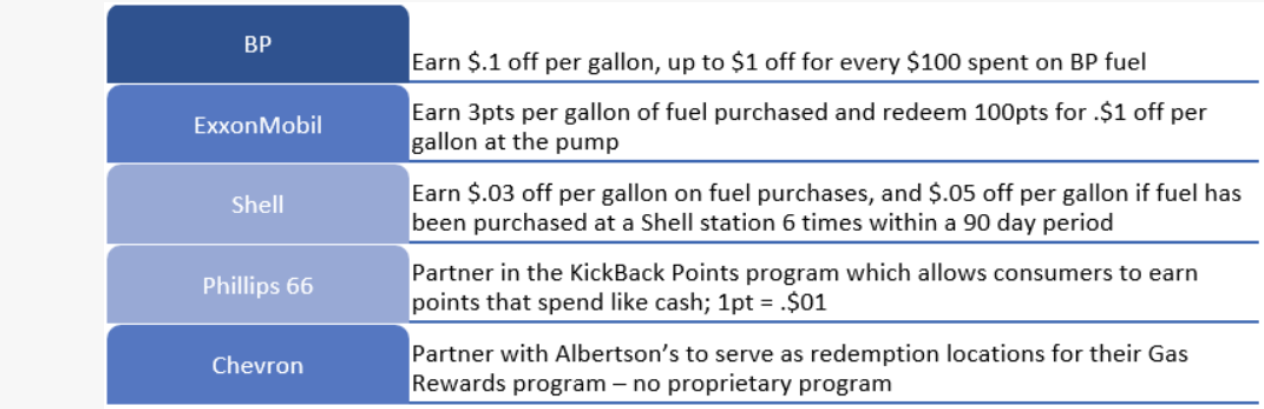

Each major fuel brand has a base loyalty offering provided to consumers:

Seen in the structure of their loyalty offerings above, there is not a large enough difference in the value proposition to sway a consumer choice from one offering to another. However, as fuel brands recognize the similarities between their base offerings they are forging relationships with other verticals to provide value to their consumers shown in the select examples below:

- ExxonMobil was a part of the Plenti loyalty coalition prior to the decision to discontinue the program. When active, the program was centered around universal currency of Plenti Points for redemption at participating retailers and restaurants.

- Shell launched Fuel Rewards, allowing consumers to earn cents off per gallon when shopping with a linked card at participating merchants, encouraging either increased spend or higher share of wallet at Shell and its partners. In addition to Fuel Rewards Shell partnered with Jewel-Osco, allowing consumers to redeem their rewards points for cents off per gallon on fuel purchases.

- BP recently launched a partnership with United Airlines allowing consumers to earn and redeem miles instead of cents off at BP locations. BP has also partnered with Pick ‘N’ Save in Wisconsin to allow consumers to redeem their rewards points at BP locations for the same value as Driver Rewards.

- Phillips 66 offers consumers a least $.05 off per gallon on fuel if they open a Phillips 66 credit card and use that card to purchase fuel at their stations.

When looking at the rollout of loyalty initiatives among these fuel brands, it is interesting to note how each brand adds features to its growing suite of partnerships, offerings, etc. By taking a hard look at the ways in which they can integrate themselves into consumers lives and by partnering across verticals which occupy critical spaces in consumer lives, such as grocers and airlines, brands are increasing their visibility to the consumer. As fuel brands seek to increase loyalty, it will be exciting to watch how different loyalty strategies affect consumer preference. To truly garner and occupy a place in the consumer’s mind and wallet, fuel brands need to evaluate what they are offering to consumers and the value that those offerings provide in terms of producing loyalty.

For further discussion, contact Mason at [email protected].