Consumers are offering data, a new currency, in exchange for truly exceptional experiences. Like monetary currencies, the value consumers receive for this new currency will vary, depending on where they exchange it. To succeed, your app must offer an experience in line with consumer value exchange rate expectations.

Mobile apps are changing consumer behavior

Consumers are now confident, that sharing their data with mobile apps, can empower them to experience ‘whatever they want, when they want it’ with access to information and the ability to act in the moment, with just a touch or voice command. This confidence is changing their behavior. Personal experiences and the experience of friends and family have become more important than brand promise, reputation, and advertising1. It is driving 77% of consumers to choose, recommend, and pay more for a brand that provides their desired personalized experience2.

The value exchange rate is critical

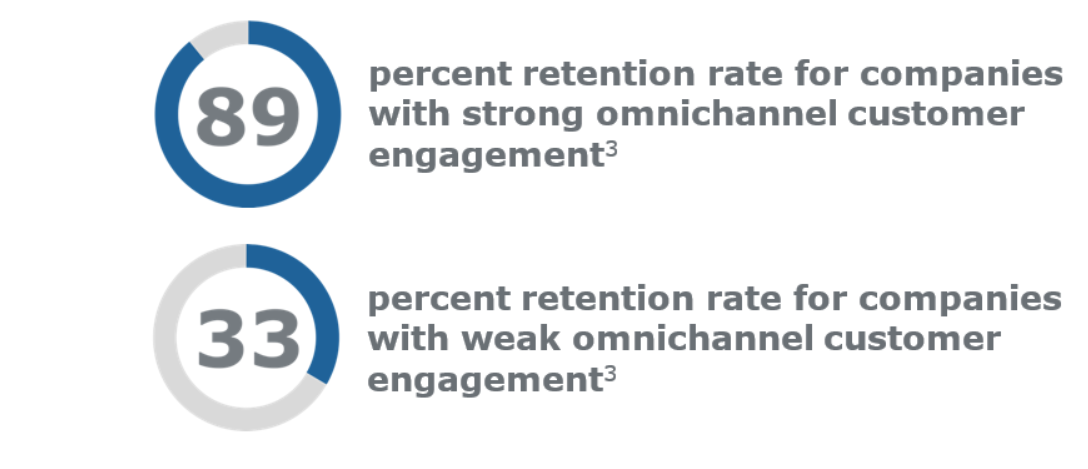

The exchange of data is required to derive the actionable insights needed to deliver an experience that meets consumers’ expectations. When you get it right, you will be rewarded with a consumer retention rate almost three times of those that get it wrong, which will increase the consumers’ lifetime value driving your revenue growth, increased share of the consumers’ wallet, and return on technology investments.

Consumers’ value exchange rate expectations are rising

The challenge facing retailers is that that leaders from all market verticals have used mobile app data to move beyond {insert consumer name here} to deliver experiences that are contextually relevant to individual consumers. You now have to compete with the experiences delivered by Uber, Starbucks, Door Dash, Postmates, Domino’s and AirBnB, even when you are selling gasoline, fountain drinks and salty snacks. This means that you need to elevate your mindset to being a technology company to compete with them and use the exchanged customer data to drive personalization and engagement.

Don’t get too personal

Consumers do not want to be lumped into a demographic segment or persona, but they don’t want to be creeped out because they feel like you’re watching them. You cannot presume too much familiarity by asking for too much information or broad permissions before you have established trust and credibility. Consumers want to feel unique and important. If you’re not investing and building for this type of engagement, you have missed the purpose of personalization.

Play by the rules

You must demonstrate to consumers that you can be trusted with their data. A clear value exchange with consumers requires a valid business case to collect their data, transparency on how you will use their data, and providing them a choice on the exchange. It also that you operate within the terms of service with the app stores.

Get started now!

Consumers expect ease and convenience at every step of their journey with you. Start by identifying your consumers’ expectations and the data you need to complete the exchange and deliver an effective experience. This will inform your engagement strategy. Identify the technology services or investments needed to execute your strategy. Start collecting, validating, and enriching the consumer data to drive the actionable insights. Deliver the consumer experience, measure your results and iterate. You will need to repeat this process in order to stay current with consumer expectations as they gain more confidence in a mobile-first world.

If you would like to learn more about the tools and strategies to accept the new consumer currency – data, you can reach Kevin Struthers at [email protected].

References

1 The Customer Experience Tipping Point, an Ipsos + Medallia Study

2 Forrester’s North American Consumer Technographics Brand Compass Survey, Q3 ‘15

3 The State of Engagement Report, CMO Council and Redpoint Global, May 2018