The latest trends in the consumer engagement sphere are tracking toward a commercial environment in which brands maintain unique relationships with individual consumers. The loyalty wires of late have been buzzing with words like personalization, one-to-one and clienteling, all of which point to the notion of a brand providing valued consumers with a custom-tailored experience. More importantly, each of these concepts, in practice, requires the effective application of a complicated data set.

While successful marketing becomes increasingly reliant on robust data sets, the most engaged consumers are becoming more sensitive to sharing their data with organizations. With sweeping regulations like GDPR and CCPA signifying further regulation to follow, retailers should expect this awareness to continue to rise.

Herein lies the paradox— while the evolution of consumer loyalty remains reliant upon robust data, the most engaged consumers are becoming less willing to provide their data to brands.

Navigating the Paradox

Today’s marketers operate in a high-pressure environment that forces them to reconcile the fact that, while 55% of them feel they don’t have sufficient customer data to implement effective personalization, 79% of consumers would be more likely to join a loyalty program that requires no more data beyond their phone number and name.

Of course, any marketer would tell you that for every additional data element requested during member enrollment, the chances of abandonment increase. With this in mind, it’s important that brands collect only the data that is essential for establishing a relationship, allowing them to build upon their data as a sense of trust is gained through the progression of the member journey.

But the question remains— how does a marketer know what data is essential to collect up front?

An Independent Study

Earlier this year, smile.io published a list of the Top 10 Customer Loyalty Programs of 2019. While the compilation of this list was based on independent, subjective research, and inclusions or exclusions may be arguable, the list effectively represents a sampling of cross-industry programs that are inarguably relevant in the consumer engagement space. For this reason, we leveraged this list as a representative sampling of brands that are utilizing consumer data in a way that is leading to successful member relationships.

The list is as follows:

- 310 Nutrition: 310 Rewards Program

- Dynamite: Dynamite Studio

- Ivory Ella: Club Ella

- NaturAll: NaturAll Club Reward Program

- Adidas: Creators Club

- Rebel Dawg: Rebel Dawgie Rewards Program

- Marriott: Marriott Bonvoy

- Unique Advantage: Devoted Darling Rewards

- Esther & Co: Royal Rewards

- Ritual: Ritual Rewards

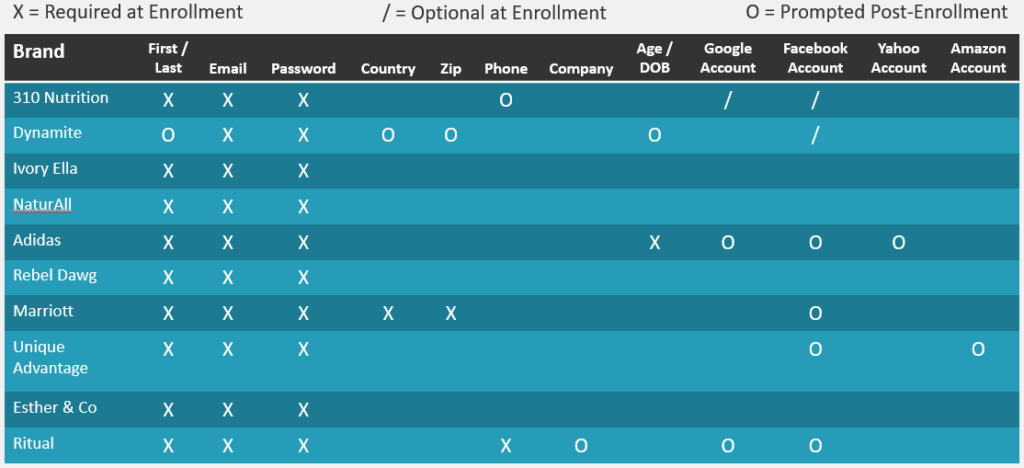

In researching this article for CAPRAplus, we examined each program on the smile.io list with a specific lens toward examining the data fields that each program collects during enrollment and in subsequent touchpoints. To ensure consistent treatment across each brand’s unique experience, we adhered to the following principles:

- In interacting with each brand, we provided all data fields required organically in the native enrollment process; if there were options (not required) to link a Google or Facebook account for a given brand, we did not link an account

- Following initial enrollment, we provided incremental data only when the brand explicitly prompted (either via targeted communications or web notifications)

Key Learnings

While each brand offered a unique and differentiated experience, we did note significant trends across initial touchpoints:

- All 10 brands required Email and Password for enrollment

- 9 of the 10 brands required First and Last Name for enrollment

- 6 of 10 brands required only three data points for enrollment (Name, Email, Password)

- 6 of 10 brands prompted for additional data points in the very first touchpoint after enrollment

- 6

of 10 brands provided the option to integrate with an existing account (i.e.,

Google, Facebook, Yahoo, Amazon)

- Of these 6 brands, all 6 provided Facebook as an integration option

- 3 of these 6 brands offered Google as an integration option

- 1 brand offered the option to link via Amazon account

- 1 brand offered the option to link via Yahoo account (in addition to Facebook and Google)

For a complete view of data provided at the beginning stages of the member journey, please reference the table below.

Applying Learnings to Engage Consumers

Of course, data collection alone doesn’t constitute a consumer engagement strategy. Effective consumer engagement is not about the data you collect, and it’s not about when you collect it— it’s about what you can do with it. In analyzing what effective brands are doing well, however, you can maximize efficiency in front-end interactions with the consumer, thus influencing consumer perception and deepening engagement.

Data collection throughout the member journey represents one component of a many-pronged approach that W. Capra applies toward generating customized consumer engagement strategies and implementations. To continue your discovery, please contact Daniel Kahan at [email protected].