Insights

What does the Kroger-Albertsons merger have to do with a Retail Media Network and why does this matter for retailers?

In late 2022, grocery company, Kroger, announced that it will be acquiring Albertsons for almost $25 billion to expand its customer reach on a national level. The acquisition, via merger, will increase the number of Kroger-Albertsons U.S. stores to that of Walmart, which currently sits as the largest grocery company in-store and online in the U.S. While Kroger and Albertsons have expressed that the merger will expand their national footprint and enable them to deliver more fresh ingredients to more people, the reason for the merger seems to be more closely tied to enhancing their retail media network strategy.

Both Kroger and Albertsons have established their own retail media networks: Kroger’s Precision Marketing with 8451 and Albertsons’ Media Collective. To compete with networks like that of Amazon and Walmart, however, the grocery giants need more geographical reach. The contemplated merger would grant the grocery giants such geographical reach with stores across 48 states. In this article, we will examine why retail media is at the epicenter of the Kroger-Albertsons merger and the implications that this acquisition will have on the retail industry as a whole.

What is a Retail Media Network?

A retail media network is a retailer-owned advertising service where marketers can purchase ad space across that retailer’s digital channels and use their first-party data to reach consumers throughout their buying journey. Amazon became the first company to launch a retail media network in 2012. Today though, we are seeing an explosion in retail media networks fueled by the e-Commerce shopping boom that was triggered by the pandemic in 2020. “As we shift more and more towards hybrid shopping, brands are seeing how much revenue can be made through online sales,” stated Kevin Struthers, Associate Director of Digital at W. Capra. “Because of this, marketers are pushing for more advertising opportunities online with a focus on those that allow them to home in on their target audience and deliver personalized messaging,”.

Kroger and the addressable consumer

From the retailer perspective, it’s evident how profitable a retail media network can be. Because of its success with retail media, Amazon is now making over $30 billion a year from advertising alone. The retailers that will have the most success in the media game will be those that collect first-party data from their customers’ shopping journeys. “Kroger’s success with the Kroger+ rewards card puts them in a fantastic position to compete with Amazon,” Struthers continued. “Kroger has been able to tie 96% of their customer transactions to their loyalty rewards card. This scale of addressable consumer data is extremely valuable to marketers of consumer-packaged goods as it can be used to target specific consumers with the right messages about brands or products that are already tied to their personally identifiable information [PII]. With Albertsons, Kroger increases its national footprint and therefore grows the scale of consumer data it has to offer with its retail media network.”

What does this mean for retailers in other verticals?

Kroger and Albertsons together have the scale of addressable consumer data needed to make a retail media network very attractive to marketers, but this focus on data monetization is happening across all industry verticals. The quick service restaurant industry has been focused on developing strong digital relationships with consumers for years. Convenience and energy retailers, particularly those with successful loyalty programs, are sitting on large amounts of consumer data and have the opportunity to turn this data into profit as well.

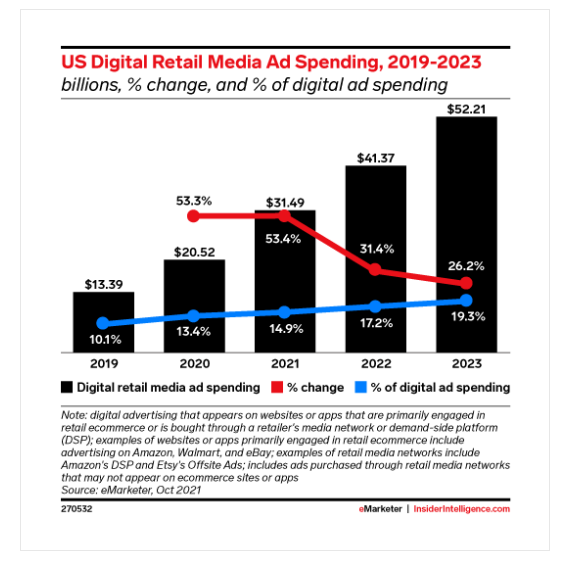

The U.S. digital retail media advertising industry is one of the fastest-growing segments of digital marketing right now with expectations of 26.2% growth and reaching $50 billion in revenue in 2023. Kevin Struthers explains, “When you look at the anticipated growth and consider that data isn’t valuable until you monetize it, retailers should be able to see the value in starting a data monetization strategy now. Executing a retail media network isn’t going to happen overnight. Convenience and energy retailers need to start by understanding what first-party data they have and then develop a strategy that involves the addressable consumer.” Engaging a third party who has a cross-vertical understanding of the retail industry, like W. Capra, to conduct this analysis will help lead retailers down a path to understanding how a retail media network can fit into their overall business model.

The world continues to trend towards digital and those that are taking the initiative to leverage the data they are collecting through digital transactions can soon reap the benefits of this billion-dollar industry.

Kevin Struthers is dedicated to leading W. Capra clients with tackling all things related to digital commerce and data monetization. For further discussion, contact Kevin Struthers at kstruthers@wcapra.com.

Related Insights

CSP Magazine – What C-Store Retailers Need to Do to Succeed in 2025

This article, by W. Capra’s Tom Newbould as a guest author, was published in the February 2025 edition of CSP […]

How Seamless is Your Customer Journey?

A seamless customer journey starts with an honest assessment of your operations. Most retailers know they need to create value […]

What’s In Store for Retail: Industry Trends to Watch

As uncertainty around the state of the economy lingers due to inflation, retailers need to be thinking about how they […]

Turn Your Customer-First Mantra Into Strategic Action

Retailers have been saying it for years, “We need to put the customer at the center of everything we do.” […]

Want to stay in touch? Subscribe to the Newsletter